How Budget Manager Works

Budget Manager helps you take control of your finances in three simple steps: record, plan, and compare.

Log Your Expenses

Keep track of where your money goes by recording your actual daily, weekly, or monthly spending.

Set Your Expectations

Add your planned or expected income and expenses to understand your ideal financial roadmap.

Compare & Adjust

Compare your actual spending with your expected plan to see if you're aligned — and make smarter choices.

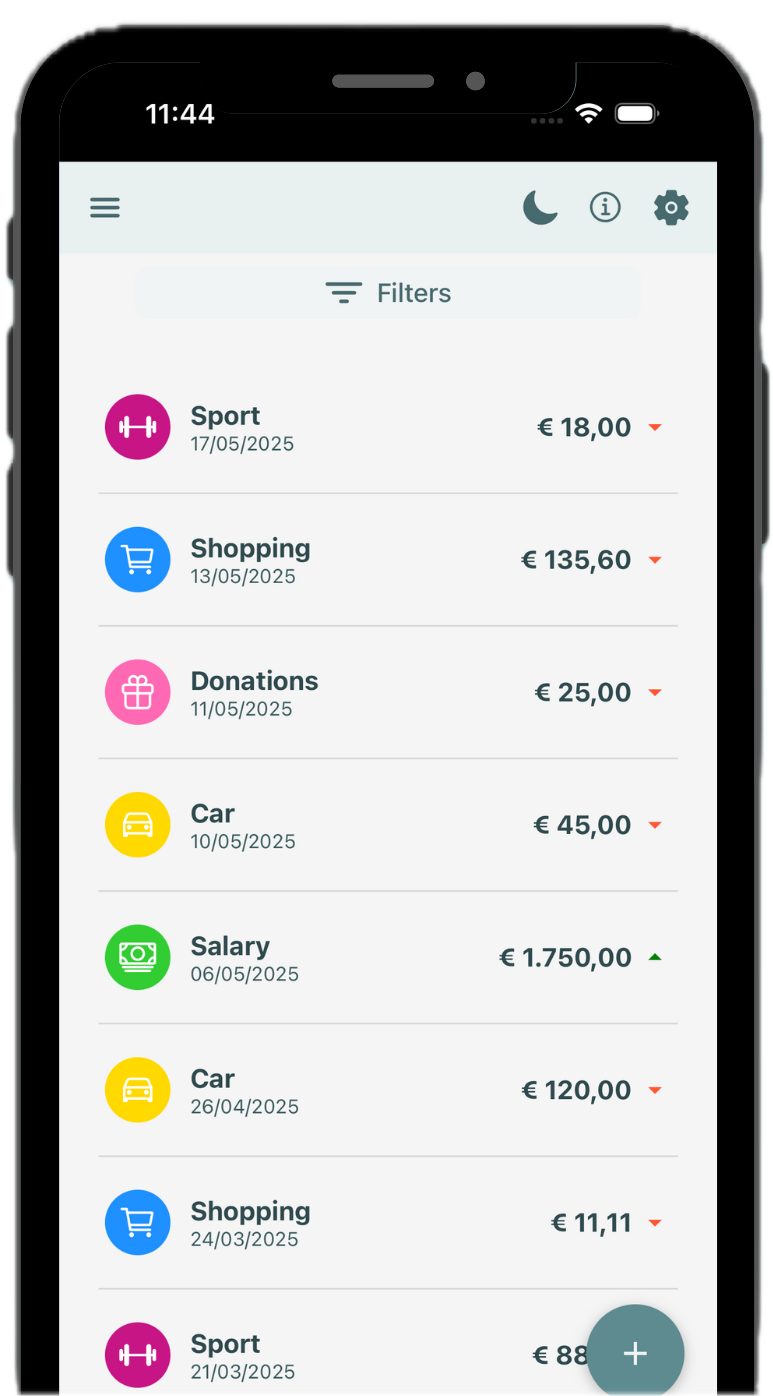

Track Real Movements

Log every expense and income across all your bank accounts, in any currency. Whether it's a coffee or a client payment, keep your finances organized, accurate, and up-to-date.

Support for multi-account and multi-currency tracking ensures your global finances are always in sync.

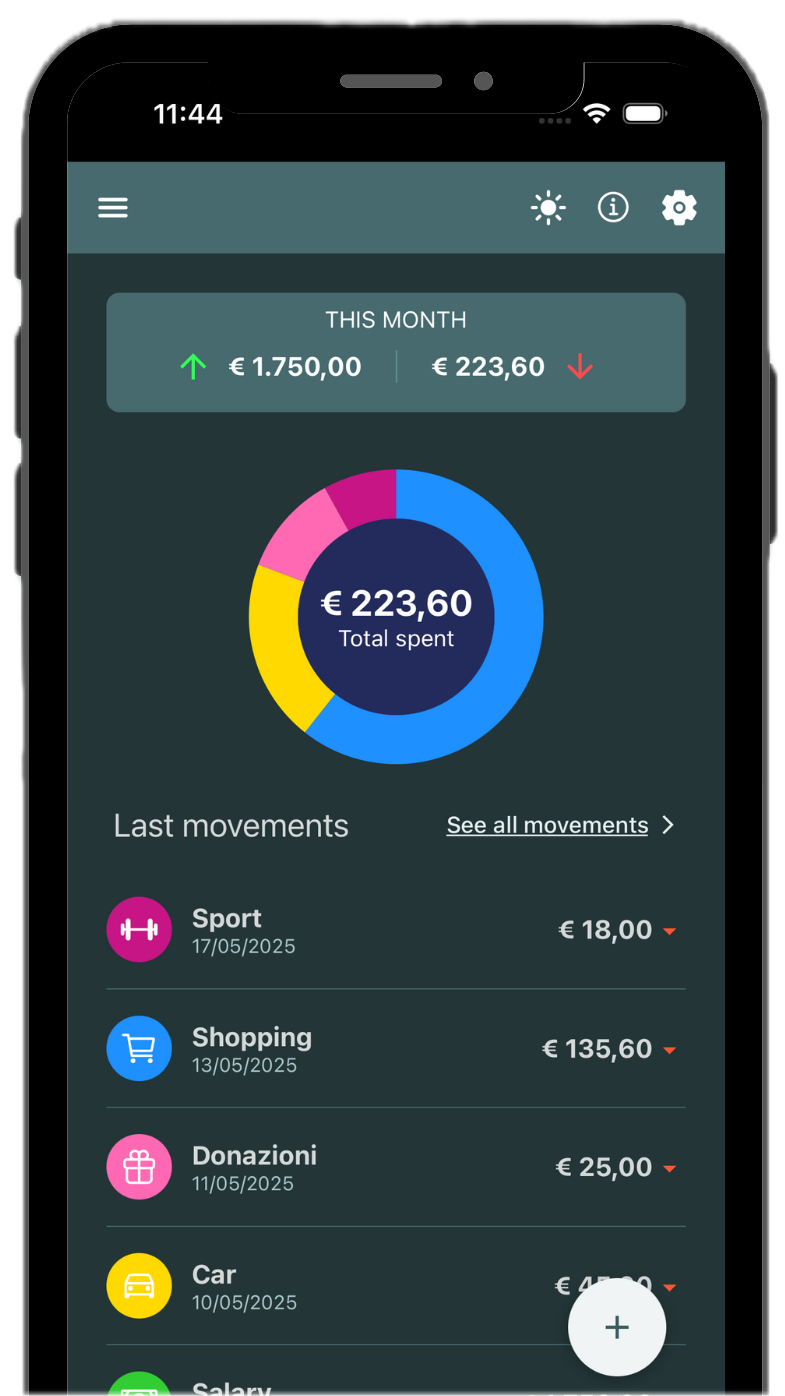

See Your Finances Clearly

Get a clean, visual snapshot of your latest expenses, income, and account balances—all in one place. The homepage gives you instant clarity and control at a glance.

Beautifully designed, easy to read, and always up to date with your most recent movements.

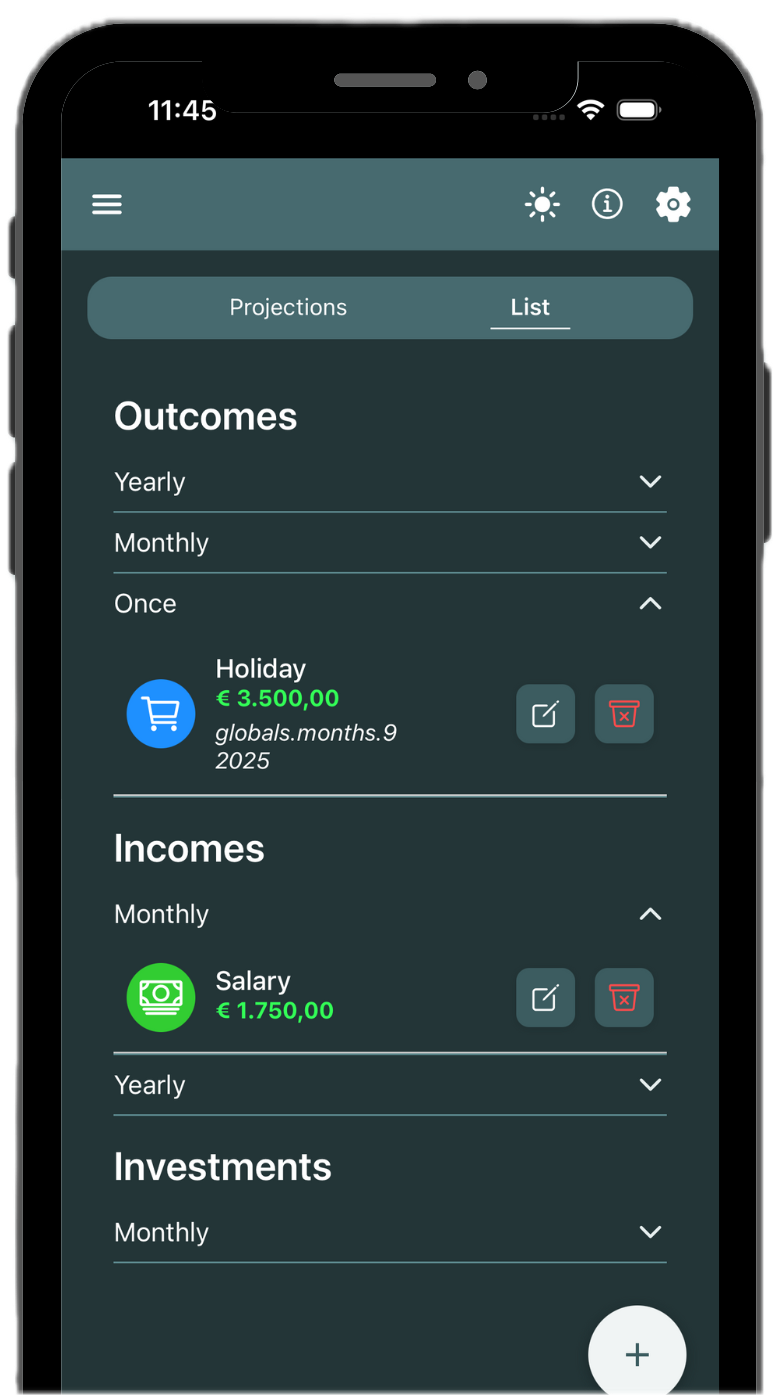

Plan Your Future Transactions

Add expected expenses, income, or investment plans, whether they’re one-time or recurring monthly or yearly. Get a forward-looking view of your financial flow and plan with awareness.

From rent and salary to savings plans and PACs, Budget Manager helps you anticipate and stay aligned with your goals.

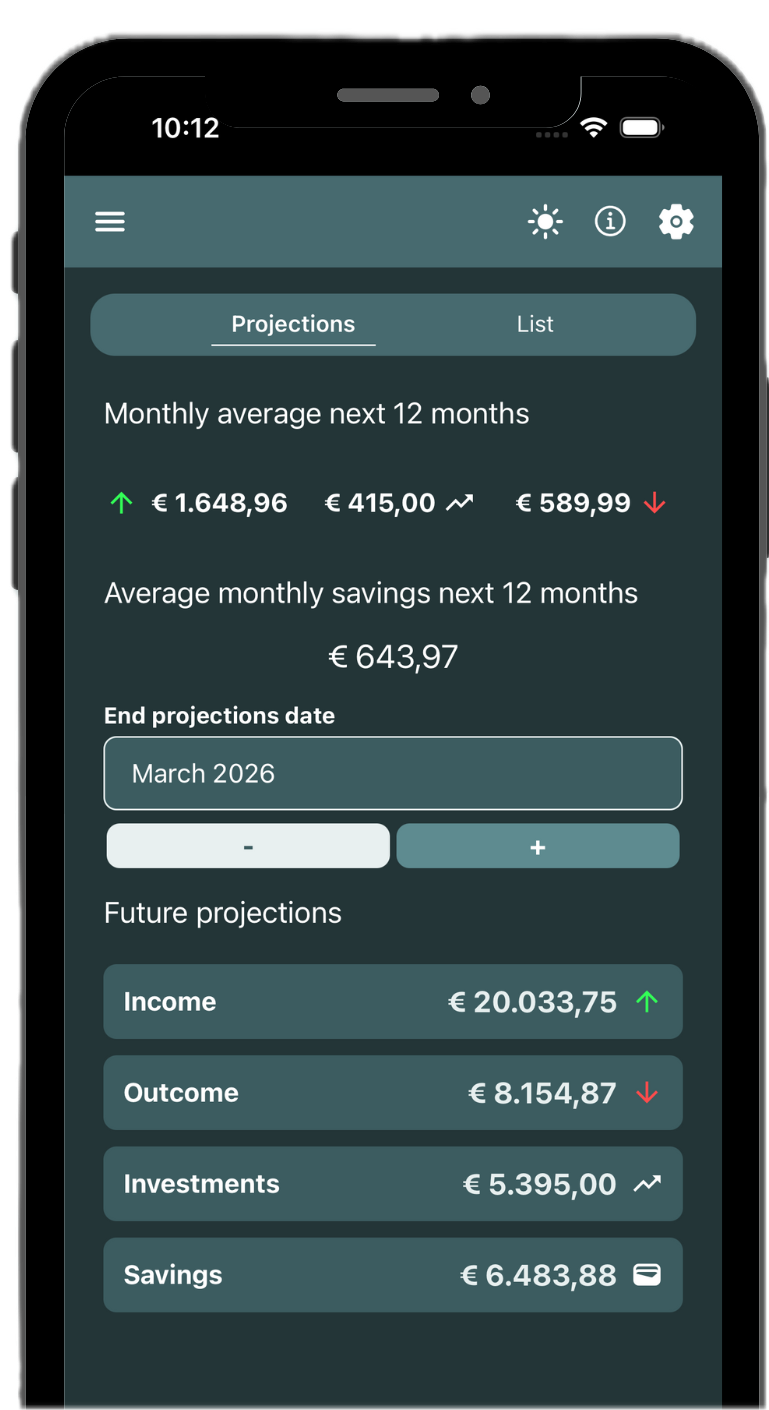

See Your Financial Future

Explore projections based on your expected movements. Adjust the lookup date to simulate how your income, expenses, and savings evolve over time.

Gain clarity month by month, spot trends, and plan your financial future based on the data.

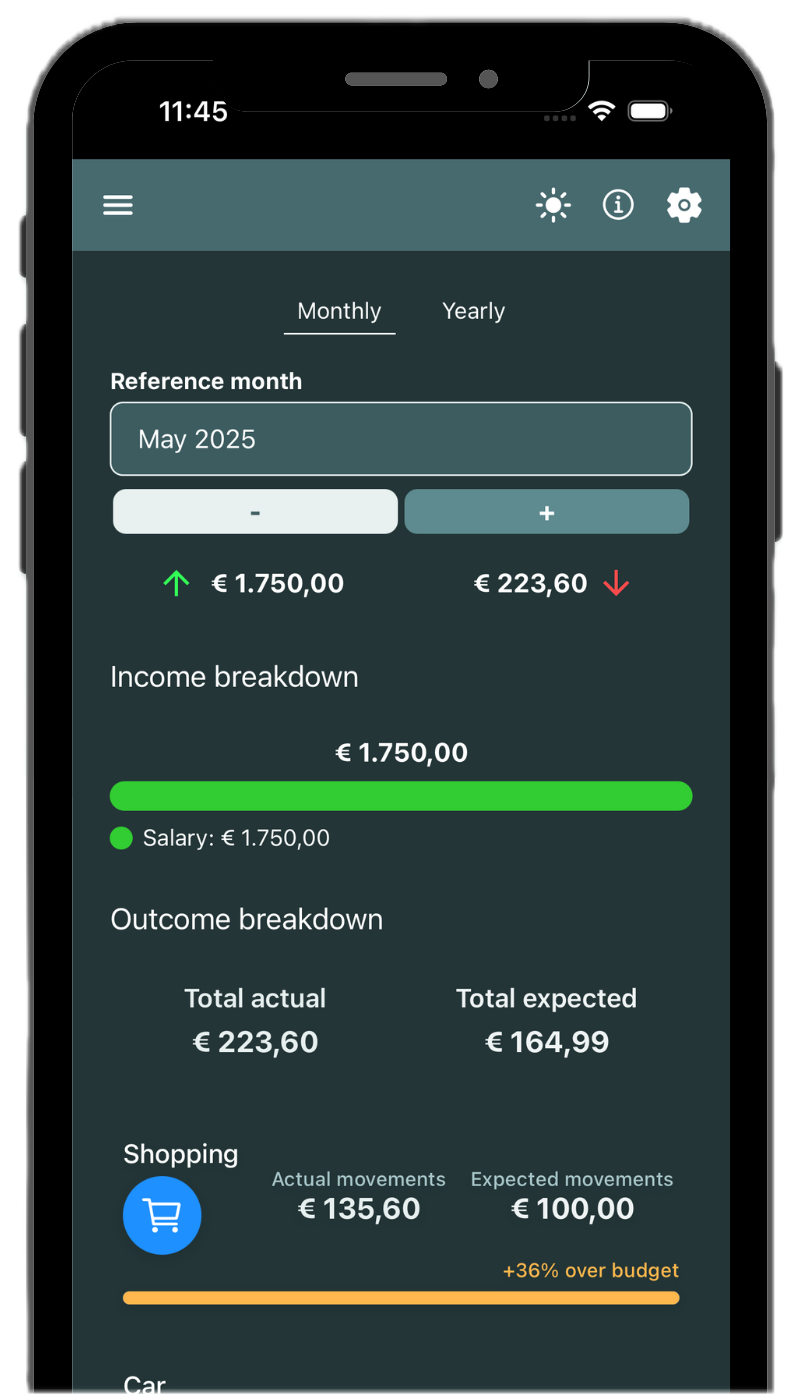

Stay Aligned with Your Goals

Use the balance view to compare your actual spending against your expected movements. Spot the gaps, understand the trends, and adjust your habits to stay financially on track.